Bademjan

The AI-Native Neobank of Iran

Financing the Persian Renaissance through structured capital, synthetic credit, and financial inclusion for 85 million citizens.

Scroll

I — Introduction

550 BCE

The Persian empire emerged on the world stage with the leadership of Cyrus the Great.

Sixty years later, his successor Darius spread the empire across three continents, reaching 5.5 million square kilometers and encompassing around half of the world’s population. The Iranian nation formed in a crucible of scorching deserts and volcanic mountains, rising from peripheral nascency to overtake the birthplaces of civilization — both Egypt and Mesopotamia.

Throughout Iran’s tumultuous past, it has repeatedly sought to restore this triumphant legacy. Empires stretching from Europe to India rose and fell; their capitals, culture, and canon remained Persian. To this day, the people hold pride in their past, and a true Iranian nationalism binds these many modern satrapies of the Iranian plateau.

Iran is yet again in the crucible.

Much like the Assyrians raiding Median and Persian villages, Iran’s own paramilitary group bathes the streets of Tehran in blood. The Islamic Republic in its current form fails to capture the power of the Persian people. The economy lays at the brink of collapse due to global isolation and poor policy, foreign countries claimed aerial supremacy over the country in mere days, and the average citizen struggles for water and electricity.

This sad reality is unsustainable, and the descendants of Cyrus the Great will rise to the occasion and rebuild their legacy. This will not happen overnight, and in the process of fundamentally changing either the governing structure or ideology of Iran’s regime, there will be much turmoil and chaos.

Yet the renewed Iran, like it has so many times in history, will shock the world order and become a civilizational superpower.

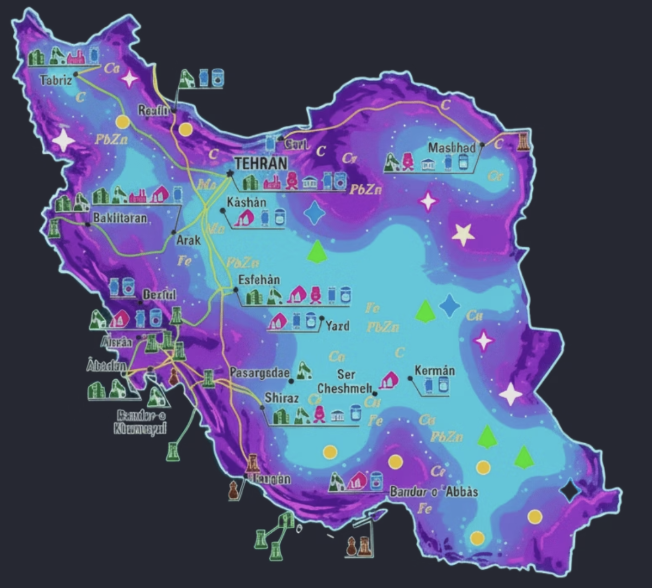

Its cities will grow higher than Dubai, its businesses will usurp multinational corporations, its resources will reorient the world economy towards the Middle East, and its citizens will achieve breakthroughs in science and technology.

Guiding this untapped nation to its potential will require structured support, capital injections, and thoughtful value creation. The lack of sustained US support during the collapse of the Soviet Union created an enemy of the world order. While the late 1990s presented a brilliant time for investment into former USSR nations, the strategic investments failed to bring about a nation that does justice to its people. The same mistakes must be avoided in the new Iran.

This business proposal outlines a plan to both generate substantial returns via the renewal of Iran’s economy and finance the stability of the new entity through providing capital to its working class and entrepreneurs.

The current Iran lacks the capital, technology, and expertise to undergo effective financial inclusion initiatives. Bademjan Bank, the AI-Native Neobank of Iran, will support the renewed nation as it faces exponential growth to its economic steady state.

Much like bademjan serves as a foundation for the kashk, this neobank will become the microfinance backbone of the new consumer economy.

Iran: The Rising Lion

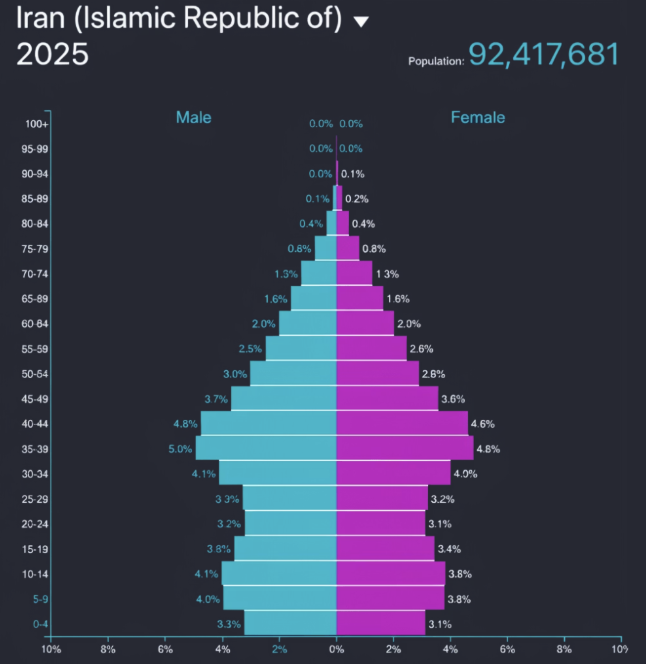

Population: 92,417,681

The Arbitrage of the Century

When regime change occurs, the delta between “flailing Autarky” and “global Goliath” creates immense opportunity. This transition moment represents the largest wealth unlock in modern history.

Bademjan will be the first foreign-backed consumer capitalizer to market.

II — Background

The Neobank Revolution

Fintechs, neobanks, and superapps have been extremely effective business models in emerging economies. As smartphones became widespread, the model evolved — from SMS banking in Africa, to sprawling payment ecosystems in China, to India’s Unified Payments Interface catalyzing a wave of private innovation on top of government infrastructure.

By the mid-2010s, a new generation of digital-first neobanks emerged. Without physical branch infrastructure, they created a tech-focused model that included anyone with a phone.

M-Pesa

2007 · Kenya

Transformed basic mobile phones into portable bank branches. By allowing users to store and transfer money via SMS, it unlocked financial access for millions who had never held a bank account.

Nubank

Brazil & Mexico

Launched no-fee credit cards and app-based accounts against historically high-fee institutional banks, growing into one of the most successful businesses in Latin America.

Revolut

United Kingdom

Spread from a simple FX app into a titan of digital banking in over 100 countries, wielding crypto, stock trading, commercial accounts, and numerous banking licenses.

MNT-Halan

Egypt

Created a financing tool for microentrepreneurs and tuktuk drivers, then grew into the country’s main private provider of digital loans, payments, and consumer finance to underserved populations.

Revenue Streams

Net Interest Income

PrimaryPersonal loans, microfinance, credit cards, overdrafts, BNPL, SME working capital, asset-backed lending, student refinancing, mortgages & auto loans.

Fees & Commissions

Interchange revenue, subscription fees, late fees, merchant processing, loan origination fees.

FX & Trading

Foreign exchange spreads on currency conversions, commissions from insurance, investments, crypto trading, and wealth products.

Reserve Income

Excess capital invested in bonds and interbank deposits. Nubank sourced 33% of its revenue from this stream alone.

Scale Advantages

No branch networks

No legacy IT systems

Front-loaded fixed costs

AI underwriting & fraud

Once compliance and backend software are built, neobanks add incremental users at low marginal cost. Long-term profitability depends on effective underwriting, balanced revenue streams, and lowering acquisition costs relative to lifetime value.

The Moat: Banking License

A banking license allows deposits, loans, and net interest income — services difficult for competitors to replicate by law. Regulators are slow to grant new ones, the approval process is costly, and customers prefer licensed banks for safety and deposit protection.

REVOLUT

Applied via Lithuania → EU deposits & lending expansion

NUBANK

Full Brazilian license → digital savings & personal loans

The Future: AI-Native

With the entrance of agentic AI, future neobanks will look drastically different. Customers may navigate the entire bank through LLM agents — obtaining loans and checking services through chat or voice.

The bank interface could morph into whatever the user needs: financial education platform, health dashboard, or instant credit calculator. The possibilities for innovative user experience have yet to be fully embraced. Bademjan intends to be the first to do so.

Expanding Access to Credit

Without credit or loan history, traditional banks struggle to allow Iranians to capitalize on their potential. With reliable credit scores after a simple online form, Bademjan implements advanced ML to determine creditworthiness.

- ◆ML models train on emerging market proxies

- ◆Outlier synthetic data generation for resilience to future uncertainty

- ◆Progressive trust building through micro-transactions

Unlocking Iran’s Digital Economy

The Proving Ground

Tajikistan First

Bademjan will first launch in Tajikistan, another Persian-speaking state with shared culture and history. This market is open to the US economy today, has a robust fintech ecosystem with high participation, and can be a testing ground for our thesis around Persian-first AI-native features in a neobank.

Tajikistan also has a robust AI credit-scoring community and a plethora of rural farmers that lack credit history to test our financial inclusion model. Our team has access to the top entrepreneurs and government leaders in Tajikistan, and can quickly rise in the market to prove Bademjan’s financial ability.

Same Language

Persian-speaking with shared cultural references, allowing direct product-market fit testing.

Open Market

Accessible to US economy today. Robust fintech ecosystem with Spitamen Bank and Alif Bank leading.

Proof of Concept

Rural farmers without credit history provide the perfect test for synthetic scoring and financial inclusion.

“Its cities will grow higher than Dubai, its businesses will usurp multinational corporations, its resources will reorient the world economy towards the Middle East, and its citizens will achieve breakthroughs in science and technology.”

Structured support. Capital injections. Thoughtful value creation.

The microfinance backbone of the new consumer economy.